The de-pegging of two stablecoins, the USDD and the USDN, has been a source of concern for South Korean exchanges. “We have received different reports that there is not an ideal maintenance of the peggings of the USDN and USDD,” the Upbit’s warning notice states.

It says, “Therefore, it’s likely that the prices of these stablecoins and their native tokens will be all over the place. Our advice to users is to do their homework before purchasing either of these tokens. ” The USD token, which is Tron’s algorithmic stablecoin, is connected to the TRX token, which is the platform’s native currency. Similar to the USDN algorithmic stablecoin of neutrino, WAVES, the native token of neutrino, is also linked.

No longer does the price of these two stablecoins remain stable Pegs have fallen out of each of them. Recent Coingecko statistics reveals a 1.5% decline in the USD during the last 24 hours. Statistics revealed a 0.1% decline in the USDN for the same time period.

Tron’s Decline Continues (stablecoin)

Prices of Tron have been falling for the past 30 days. The constant drop in Tron’s value, according to many observers, is due to the USDD’s de-pegging. Other stablecoin players have claimed that the USD is an over-collateralized stablecoin in various ways.

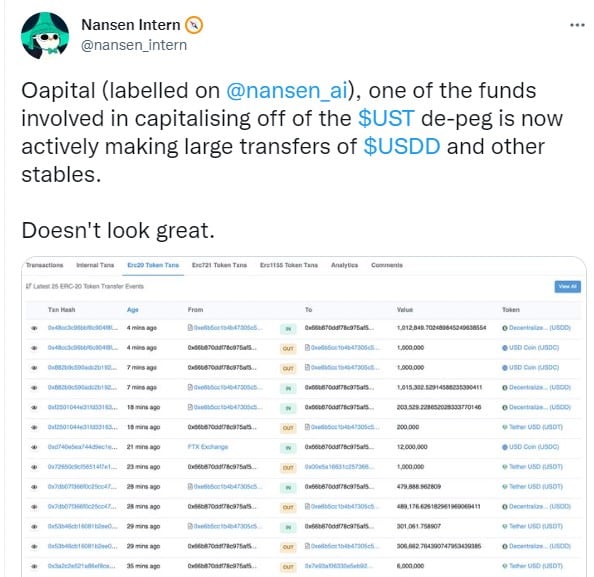

This fund, which gained from the de-peg of the US dollar against the euro, has been moving large amounts of USD and other stablecoins, according to Nansen (a blockchain transaction tracking tool).

For the First Time, South Korea Has a Digital Assets Authority

As a response to the failure of the terra network, the South Korean government established a body to monitor cryptocurrency-related activity. The board was formed in the first week of this month by the South Korean government.

The delisting of LTC from several South Korean exchanges was revealed just last week. Litecoin’s developers introduced a new privacy feature, which led to the delisting. Anti-money laundering policies would be violated by the new function, according to the exchanges. Because of this, they can’t guarantee the safety of Litecoin investors when they conduct transactions involving the cryptocurrency.

MORE ARTICLES:

New Security Features for the NFT Marketplace

Report: Crypto hackers can take advantage of a vulnerability in Intel and AMD processors.

A Beginner’s Guide to Cryptocurrency’s Annual Percentage Yield (APY)

The new digital asset board is working hard to ensure that all activities in the country’s crypto sector are regulated, as seen by the exchanges’ consistent decision. Korean finance watchdog chief lee bok-Hyun has made some suggestions about tougher crypto laws.

[rb_related title=”More Read” style=”light” total=”4″]

Finance experts are involved in the establishment and interpretation of cryptocurrency policies, according to him. ” As a result, we’d take a closer look at the policy’s most crucial features.”

It’s been a rough few days for cryptocurrency investors.

BTC is currently trading below the $22K level due to widespread panic selling throughout financial markets. Coinmarketcap statistics shows that BTC is currently trading at $21,418.67.

More than $1 trillion has been wiped off the cryptocurrency market’s value in the just 60 days. Global crypto market valuation is now $983.72 billion, according to data from Coinmarketcap. When compared with previous year’s estimate of $2.9 trillion.

Leave a Reply